Chancellor revisits CBIL scheme following recruitment industry lobbying

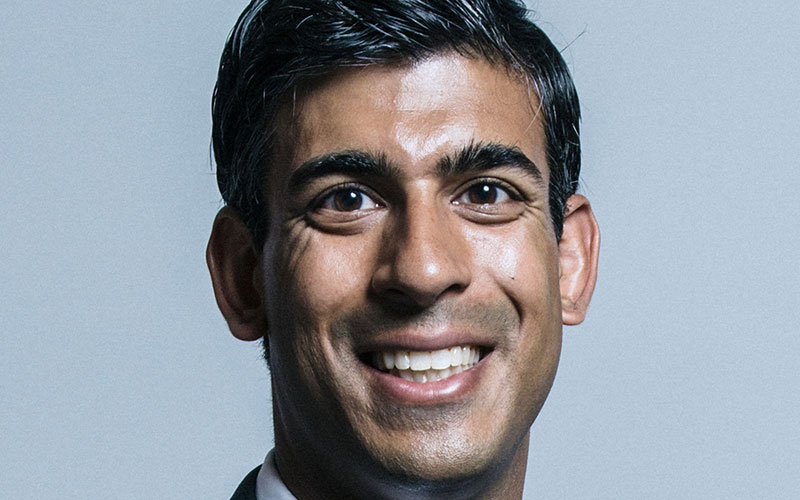

Chancellor Rishi Sunak has revamped the Coronavirus Business Interruption Loan (CBIL) scheme following campaigning from two of recruitment’s biggest trade bodies.

Under changes to the scheme announced this morning by the chancellor:

- Applications are no longer limited to businesses that have been refused a loan on commercial terms.

- The scheme will offer government-backed loans of up to £25m to firms with revenues of between £45m and £500m.

- Banks can no longer ask company owners to guarantee loans with their own savings or property when borrowing up to £250k.

The move follows campaigning from the REC and APSCo.

The REC revealed yesterday that it had written to business secretary Alok Sharma putting forward four solutions to help workers, companies and the government alike during the coronavirus crisis.

These solutions include:

- Allow high cashflow businesses to claim emergency grant support for wages now, which is then deducted from furlough payments when they become available.

- Ensure that banks and insurance providers play fair and provide the necessary support quickly, without making unreasonable requests from businesses or seeking to wriggle out of payments on technicalities.

- Government to cover Statutory Sick Pay costs for two weeks for all workers, regardless of the size of the business or whether the employee is temporary or full-time, so that hirers and agencies can place temporary workers with confidence.

- Find a way to support directors of owner-operated limited companies who have largely been left unprotected by the government’s measures so far.

This morning, Neil Carberry, CEO at the Recruitment & Employment Confederation, called the changes helpful as they expand the scope of help the CBIL process offers.

“There is more to do to ensure that bank requests for guarantees from businesses are appropriate, where owners have already injected their cash into the business. Raising the £250k bar for lending without guarantees would help, or only asking for guarantees for the 20% of the loan value the government promise does not cover.

“But businesses in high cashflow, thin-margin sectors – like recruitment and staffing – need quicker support than CBIL is likely to be able to offer if they are to navigate this challenging time and look after their people. This is especially true for temporary agency work providers who pay their workers on a weekly basis, and cannot afford to furlough them unless there is far greater speed and clarity about when government support will be available – and access to those funds quickly.”

Also commenting on today’s development, APSCo CEO Ann Swain said: “We are pleased that the government has listened to the concerns APSCo raised in our recent letter to the CEO of the British Business Bank, which was copied to John Glen, economic secretary to the Treasury.

“The fact that he has banned banks from asking for personal guarantees for loans under £250k, has made it clear that businesses should be able to apply directly for a CBIL without being offered other products and will be making operational changes to speed up access to the finance were some of the main asks in our letter.

“We have been undertaking weekly sentiment surveys of our membership and have been extremely concerned at the feedback we have been getting about the behaviour of some of the banks.

“One member said: ‘The bank won’t let us apply until we have burned through our own cash and only have a few months’ worth of payroll left’, while another said: ‘I spoke to my bank and they indicated they would still require a director’s personal guarantee even though it is a government-backed security.’ Other members spoke of higher than normal interest rates of between 7-12% and a tendency to try and sell products other than the CBIL.

“We sincerely hope that this announcement will give the banks clarity on what they need to be doing and we look forward to seeing transparent, publicly available guidance being issued by the British Business Bank directed at the banks, on applying discretion in decision making on eligibility, credit worthiness and appropriateness of the scheme to individual circumstances. We will be monitoring the experiences of our members closely and reporting back to government on any issues.”

• Comment below on this story. You can also tweet us to tell us your thoughts or share this story with a friend. Our editorial email is [email protected]