Recruiter HOT 100: Herculean efforts, defying gravity

2021 has seen a sea change in recruitment fortunes.

On the back of a brutal year in 2020, as evidenced in this report, the recruitment market turned from a lack of vacancies to a lack of candidates across several large sectors – for many in the space of just a few weeks during Q1 2021. This rebound has continued until late 2021 and should be well reflected in these columns next year.

The ability to adapt to new working practices was a learning curve through 2020 and finely honed by this year, enabling full benefit from such a market turnaround. However, a word of caution – it has also become a race to resource experienced consultants and, anecdotally, capacity is now holding back so many companies. This situation should partly improve as trainees mature so, if economic challenges do not de-rail the labour market recovery in the UK, a strong outcome is anticipated not only for next year’s HOT 100 but in years to come. But any future success of these recruiters is the direct result of their good decision-making during the depth of this pandemic and still now, together with the foundations of these past years.

As usual, this 2021 HOT 100 reflects past performance, either in 2020 or early 2021, and most companies’ accounts are mainly affected by the Covid-impacted period. The HOT 100 could have been changed or even abandoned for the year but the results prove the decision to carry on was vindicated. Yes, there was a sharp drop, a step change, in the entry level and no, we could not easily account for headcount on furlough (and we explored all options) but the best companies still rose to the top. Once again, best practice and ethics have shone through – all good for the stature of the recruitment industry on the national stage.

Despite the clear impact of Covid during 2020 on most recruiters’ financial results, specific sectors such as IT, logistics, food and life sciences – with STEM and IT especially taking a materially increased share in the HOT 100 – have made significant gains. Evidence also suggests in the following analysis that the smaller companies making up the bulk of the HOT 100 have moderately out-performed their larger peers during this period, making measurable progress certainly.

So, despite the unprecedented restrictions on trade and loss of activity precipitated by the Covid pandemic during 2020 and beyond, just how well did this ‘best in class’ excel? To answer this, here is the 2021 HOT 100.

Key findings

2021 HOT 100 group sales turnover declined by 12%, closely in line with the wider UK recruitment industry sales turnover drop of 12.7% reported for calendar 2020 by the Office of National Statistics. Like for like, comparing this group against their own figures for the previous year:

- The 2021 HOT 100 companies collectively reported a sales decline from their previous year in latest available accounts of 12% to around £19.6bn.

- HOT 100 combined gross profit (GP) reached £3.7bn, a decline of 17% versus their prior year.

- HOT 100 companies’ in-house headcount fell 10.3% to total 39,791 employees. Important to note that furloughed employees remained on the headcount (and payroll) but may have been stood down for several weeks or months, thus inevitably reducing overall company productivity.

- Productivity (GP per employee) for this group of HOT 100 companies fell by 7.4% over the year to an aggregated average of £93,984. A simple average of each of the GP/head figures, neutralising the heavily weighted skew of the larger employers across both years, stood at £107,570, nevertheless still 5.1% below their 2019 level.

- If all seven recruiters with GP exceeding or approaching £100m are excluded, the headcount percentage reduction is steeper whilst the GP shortfall slightly improved at 16.1%. This equated to a less severe drop in productivity of 5.3%. It is difficult to determine whether this was due to a speedier, flexible, more agile response from the smaller recruiters as the Covid impact unfolded or an intentional ‘hold tight’ approach from those very large companies. However, the latter would arguably have been better equipped to take more immediate advantage of government support programmes and initial preservation of their workforce.

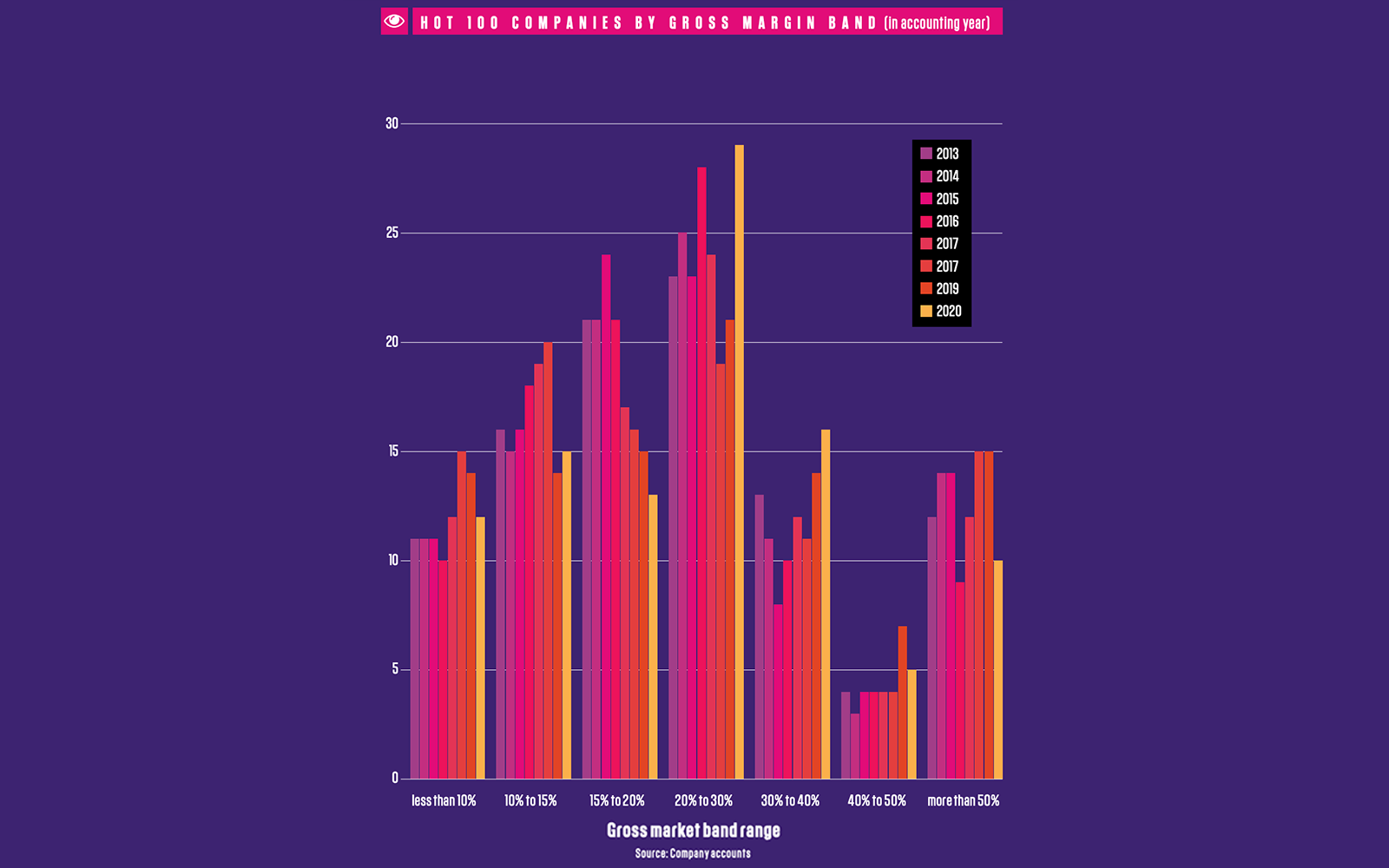

- HOT 100 average gross margin eroded by 110 basis points versus their prior year to 19.1% versus 20.2%, mainly attributed to the near cessation of recruitment during the first lockdown in Q2 2020 and a significant shift in the relative mix towards temporary and contract placements within the context of overall reduced business levels. Excluding those seven largest recruiters – which together incorporate substantial overseas operations – the remaining 93 averaged just a 30 basis point drop in gross margin albeit already a full step below their larger peers at a much lower 16.9% versus 17.2% prior year. By contrast those seven large companies posted an average 160 basis point drop to 20.3%. Ample evidence points to a change in business mix, led by lockdowns and Covid uncertainty, which very substantially reduced permanent recruitment volumes and fees across much of 2020.

- Incremental business loss analysis: This HOT 100 group in their past financial year shed £764m in net fees and 4,563 in staff at an incremental gross margin of 28.6%, losing an incremental £167,390 incremental GP per head. This is the clearest evidence possible that the industry’s mix has shifted significantly away from permanent towards temporary business. This accentuates the trend seen in 2019; it cannot be too much emphasised just how unusual are these past two years – 2019 and 2020. Excluding those seven largest earners – the incremental margin of the remaining 93 averages 19% and their GP/head drops almost to £155,000, still signalling a lowered permanent to temporary ratio of fees even across the smaller companies. Nevertheless, a push-back towards more permanent business is widely expected to be evidenced in next year’s HOT 100.

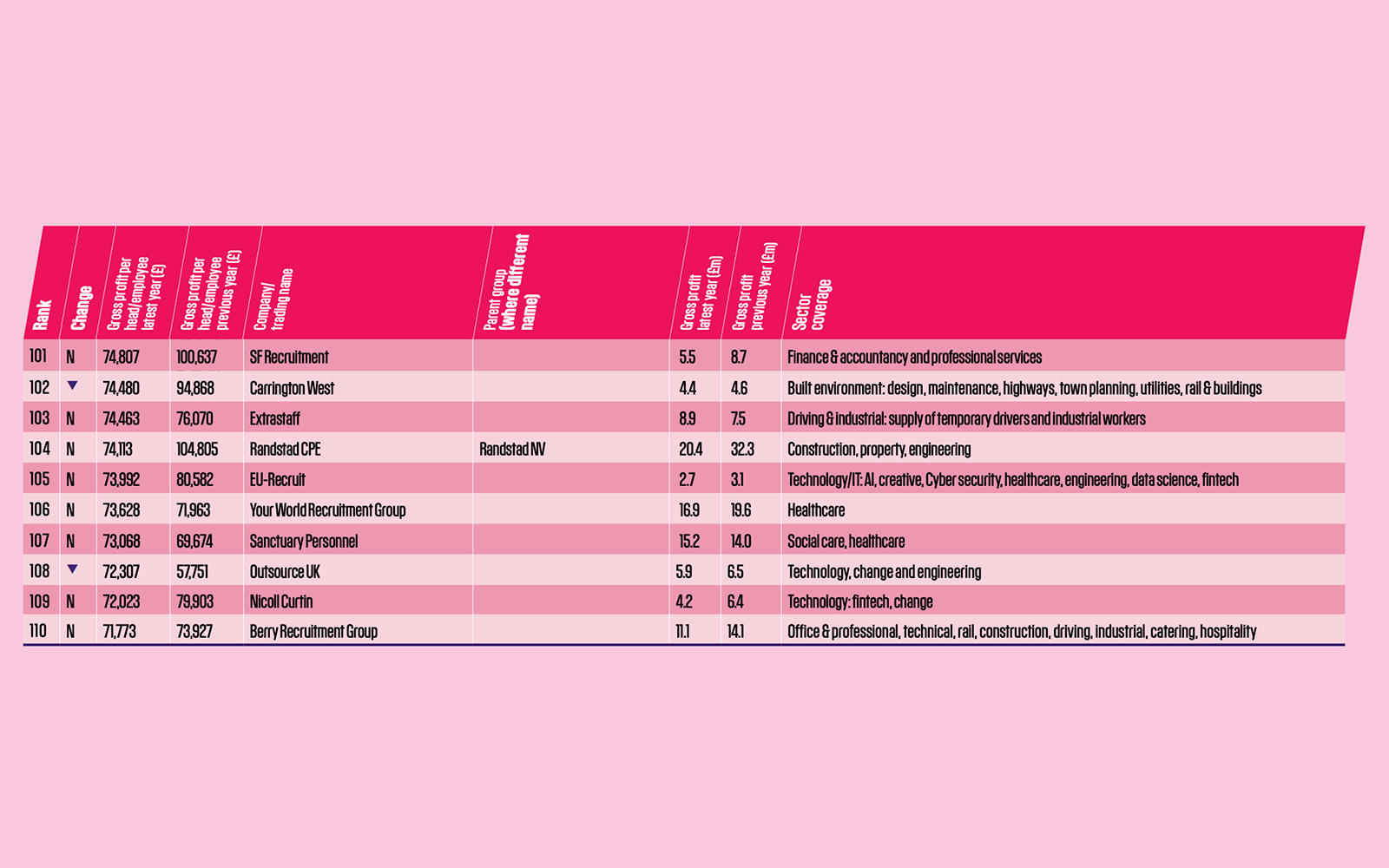

- Entry level GP/head (ranked 100) to the 2021 HOT 100 dropped very sharply to £74,825, the lowest for almost a decade and £9,250 below the prior year threshold for the ‘cut’ at £84,075. Amongst the pursuing companies GP/head falls away much quicker than in prior years (below £70,000) at the 117th ranked with very many IT, engineering and professional role recruiters below this level.

- Individual productivity growth ranged from +49.9% to -35% with 37 companies out of the 100 reporting some growth compared with 55 last year. This seems to be a very robust outcome given the circumstances, furlough of some staff and general market conditions for much of 2020.

- 15 companies saw individual growth in net fees versus last year’s 71 companies.

- 6% of HOT 100 companies achieved the dream combination of expanding productivity whilst simultaneously increasing their internal headcount. Comparisons are unfair against last year’s 33% given the pandemic impact upon the market and the furlough scheme which kept staff on the payroll when they were purposely not engaged in the business. These six companies were skewed towards smaller employee size bands with very large employers not represented.

Covid impact and its limitations on this HOT 100

Whilst many companies resumed their previous filing timetable with Companies House, some companies appeared still to have a three month extension. So last year’s challenges for the HOT 100 production team have not entirely disappeared. Inevitably, some accounts were not yet filed when this report went to press, meaning a handful of companies are excluded from the ranking. Despite examining a variety of methods to mitigate for furloughed employees and sharply reduced business levels, none were sufficiently rigourous so we have proceeded as normal, measuring gross profit (GP) per head to provide consistent comparison. Thus, while a downward step change has been seen through a much lower entry threshold, the integrity of the HOT 100 is preserved. We are grateful to the wider recruitment community that helps to make this possible, often by providing advance copies of accounts.

Size profile

- Overall, 23 of HOT 100 companies employ at least 200 staff, a rise of two versus last year. A further 16 employ between 100 and 200 staff. Once again there are 10 very small firms between 20 and 30 staff. The 30-49 band remained at 23 and the employee band 50-99 eased back to 28. This offers a fairly similar profile by employee size bands across this HOT 100 relative to recent years.

- The average size of the 2021 HOT 100 dropped by 6% to 398 employees, like-for-like vs last year. Excluding those same seven largest, where group accounts have been used, the average size is only marginally down on last year at 110 staff.

- Amongst the large corporate groups in the HOT 100 with standalone subsidiaries, Manpower’s Experis and People Source Consulting are highlighted, whilst the nGAGE stable now has seven companies making the cut. Pertemps’ driving operation, PPF, is also included whilst just below the HOT 100, Randstad returns with its CPE business. Rullion consolidated accounts were used instead of its separate Engineering and IT businesses.

Sector profile

- Across the HOT 100 there are 49 IT companies, 21 Professionals, 17 Technical recruiters, nine Public Sector and four in the category of Office/Industrial/Trades.

- In the top 20, representation stands at just three Professionals listed, of which two made the HOT 10. Twelve IT staffing companies are listed in the top 20, with seven of these ranked in the HOT 10 while the top 20 balance comprises two Professional Executive/Public Sector firms and three Technical recruiters (one in the HOT 10). Again, there were no Office or Industrial specialists this year.

- Drilling down to the HOT 10 by sector, all the constituents are highly specialised recruiters. Technology/IT has further gained share, dominating now with seven constituents. In addition, there are two professional and one technical company. Timing absences this year would more likely include even more IT or technical companies. The constituents are mainly small to medium in size (all but LA International employs below 100 staff). The big technical engineering firms have dropped out of the HOT 10 with much smaller NRL the only one making it into the HOT 20 of the ranks.

Margin trends

Gross margin is the gross profit (or net fees) as a percentage of sales turnover. Gross profit is a combination of permanent fees (at virtually 100% margin) plus the profit on temporary supply after subtracting payroll and other ‘temp’ employment costs. The mix of business between temporary and permanent placements influences the level of gross margin as does the trend in temporary pricing and employment related costs. With larger contract business notoriously competitive compared with SME or ad hoc placements, the type of business and delivery model/cost structure play a crucial part both in determining temporary margin and also bottom-line profitability.

Outlook

When we repeat this exercise at the end of 2022, analysing 2021 company performances, hopefully Covid will have had reduced impact on people and economies. 2021 has proved to be a year of enormously diverse outcomes. Covid has ebbed and flowed but never lain down, whilst geopolitically huge stresses and challenges remain ranging from climate change, energy pricing and supply chain issues to military muscle flexing from the major powers. Economically and financially there are many question marks and few answers. Finally, however, recruitment appears to have reached the top table of decision-makers. Workforce skills and talent resourcing are now central to the decision-making and strategy of virtually all companies with even governments taking note.

Despite the difficulties in 2021, the recruitment industry has experienced strong recovery back to and beyond 2019 sales levels. It is expected that the permanent market has finally started to rebound, and the impact upon the 2022 HOT 100, based upon this past year, will be quite profound. In 2022, even a slowdown in economic growth could be mitigated by continuing significant skill shortages. Any lockdown early in 2022 will show us how we have learned to work through Covid – how much remote working, improved productivity metrics, a better work-life balance and technology shifts have now permanently changed the profile of the labour market itself whilst no longer harming the economy in the way that was seen back in Q2 2020.

Recruitment is at the forefront and has now reached a watershed opportunity to cement that seat at the top table and drive strategies which put people at the centre of future economic development. The professionalism of the UK recruitment industry and those companies which strive to reach the HOT 100 are ideally suited to succeed.

Agile Intelligence

Agile Intelligence has compiled the HOT 100 Report on behalf of Recruiter to determine which companies are best at leveraging their intellectual assets. By rigorously measuring the gross profit (net fees) per employee this indicates how effectively an organisation uses the skills of all its own people to generate a profitable return for stakeholders. All in-house employees (excludes temporary workers or contractors) are included in the calculation – not just fee-earners; this is a standard senior management Key Performance Indicator (KPI). Notwithstanding wild cards, companies emerging strongly from this analysis, especially if featuring regularly, are primarily those that operate the most productive organisation, balancing the need for good, well-trained, directed and motivated staff against the need to minimise costs.

Download PDF of the Hot 100 companies