Rise in contractor rates

Few will be surprised that one effect of updated IR35 legislation is that most employers have had to increase the rates of pay for their contractors, according to new research

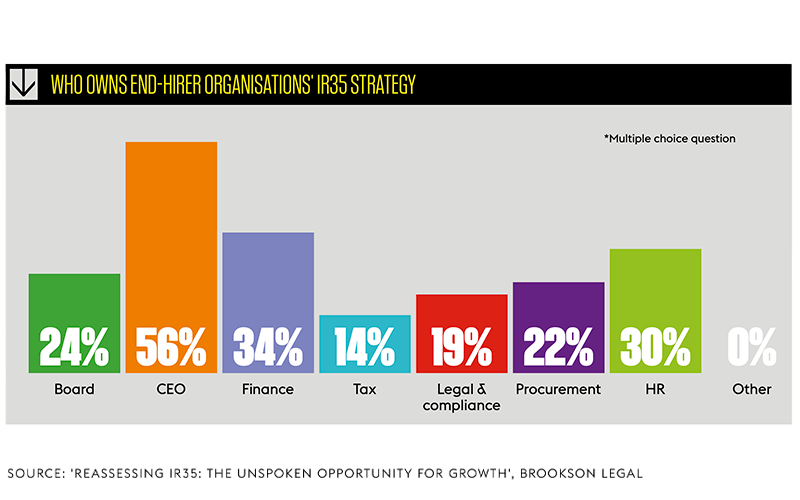

Since April 2021, when it became the responsibility of end-hirers to determine the employment status of their contractors and ensure correct taxes are paid, a massive percentage of employers have been forced to increase their contractor pay rates, new research by Brookson Legal has found.

Construction businesses have seen the highest volume (32.3%) of contractor rate increases of more than 20%, and information & communications services the highest volume (58.7%) of rate increases of 11-19%, according to the report, ‘Reassessing IR35: The Unspoken Opportunity for Growth’.

With 87% of employers reporting that they have had to increase the rates, 22% say they have increased their contractor pay rates by 0-10%, 47% have had to increase the rates by 11-19% and 18% report a 20%+ increase. Of employers who have not increased their contractor pay rates, 10% say they have not hiked them yet, 2% say they don’t plan to increase their rates and 1% don’t know.

“When the off-payroll working rules were first announced in the private sector, many businesses worried that they would not have time to fully manage their new responsibilities,” the report says, “and 57% of HR decision makers we spoke to in 2019 were considering a blanket approach to determining the status of their contractors to meet the deadline. In the same survey, 41% feared they would lose contractors if they were incorrectly assessed.”

The fears were rooted into high-profile mismanagement of the changes to off-payroll working rules governing the public sector in 2017, “which resulted in a contractor talent drain disrupting the delivery of major projects”, the report points out. “More recently, we have seen a series of high-profile tax bills that have revealed just how significant the financial penalties of getting IR35 wrong can be,” with even government departments facing millions of pounds in tax liabilities for mismanagement of the IR35 rules imposed on the public sector (see Viewpoint on p16).

If we wanted CEST to determine 100% of all cases, we would have to make it quite complicated”

At the same time, the Brookson research (conducted by market research agency 3GEM) found that potential HM Revenue & Customs liabilities worried private sector decision-makers less than other fallout from the new private sector rules. Commercial risks topped their concerns, including contractor costs (53%), talent attraction (42%) and project delays (42%). A comparatively small 31% had concerns about unforeseen tax bills that would stem from IR35 issues.

But with the seeming optimism – 88% believe that they understand the guidelines as to what is ‘reasonable care’ in making IR35 status determinations for their contractors – comes a caveat of “false optimism”, the report says, given the practices that are occurring in the businesses surveyed:

- 47% relied on the government’s Check Employment Status Tool (CEST) to make status determinations

- 42% relied on another automated tool to make status determinations

- 34.6% asked contractors to assess their own status, while 31.4% delegated to agencies

- 25% applied a blanket “inside IR35” approach to status determinations.

Relying on automated tools alone to make the status determination is a tax risk, the report said. As the House of Lords Finance Bill Sub-Committee heard in a 13 December 2021 session, CEST was designed to give a clear determination in only 80% of cases.

“If we wanted it [CEST] to determine 100% of cases, we would have to make it quite complicated,” said Lucy Frazer MP, financial secretary to the Treasury, who was questioned along with HMRC representatives yesterday by the sub-committee for over an hour.

“So HMRC has made a decision that in order for it to be easy to use, not expensive, not take up too much time, it’s going to deal with 80% not 100%.”

The remaining 20% could obtain telephone support to work out their status, Frazer said.

The sub-committee chair, Lord Bridges of Headley, countered by quoting the CBI as describing the CEST tool as “oversimplified. This is the problem now we’ve got to, which is it’s now oversimplified, and specifically on mutuality of obligation. It’s not in there because it’s so difficult. Therefore, it’s a tool that really is not worth it for many people”.

Recruiters will be relieved with the inclusion of a warning against end-hirers relying on them for status determinations. “Asking the recruitment agent to conduct the IR35 assessment or relying on one provided by them is a red flag,” the report said. “The agent is the party least aware of the working practices and intentions of the parties, but this approach can remove visibility of your flexible workforce and bury risk in the supply chain – putting both agents and end-hirers at risk of IR35 fines and tax bills.”

For the 25% using a blanket approach, the report said, 89.5% have sent an increase in contractor costs, and 30.6% had “lost visibility” of contractors. But, the report warned, “blanket inside IR35 status determinations are not a sustainable approach to managing the IR35 changes… a blanket approach blocks access to skilled contractors who are required for in-demand outside roles. To attract talent, pay increases are commonplace to balance out income lost to employment taxes”.

Also pointed out are the compliance risks to demonstrate ‘reasonable care’ when determining the IR35 status of the personal service company, or contractor, employers engage. “It remains the ultimate responsibility of the end-hirer to ensure the correct amounts are paid to manage associated debt transfer or Criminal Finance Act risk,” the report said.

“Encouragingly, 90% of [employers] plan to increase their use of contractors in the next 18 months,” the report said. “However, one thing is clear: businesses that want to grow in this environment need to present the most attractive, compliant and competitive package to the flexible talent they need. Those that don’t risk being left behind.”